Karen James

Nigeria’s downstream petroleum industry is experiencing a state of unrest as clear indications arise that the Federal Government may no longer sustain the cost of under-recovery, commonly known as subsidy. The steady rise in petrol import bills has led industry operators to believe that an official pump price increase may be imminent. This move would allow the government, through the Nigerian National Petroleum Company Limited (NNPCL), to generate sufficient funds to settle outstanding bills owed to international dealers for credit supplies.

Industry operators speculate that a compromised pump price of N1,000 per litre or potentially higher might be on the horizon. Some even quote the landing cost of the product at approximately N1,200 per litre, excluding the delivery costs to petrol stations.

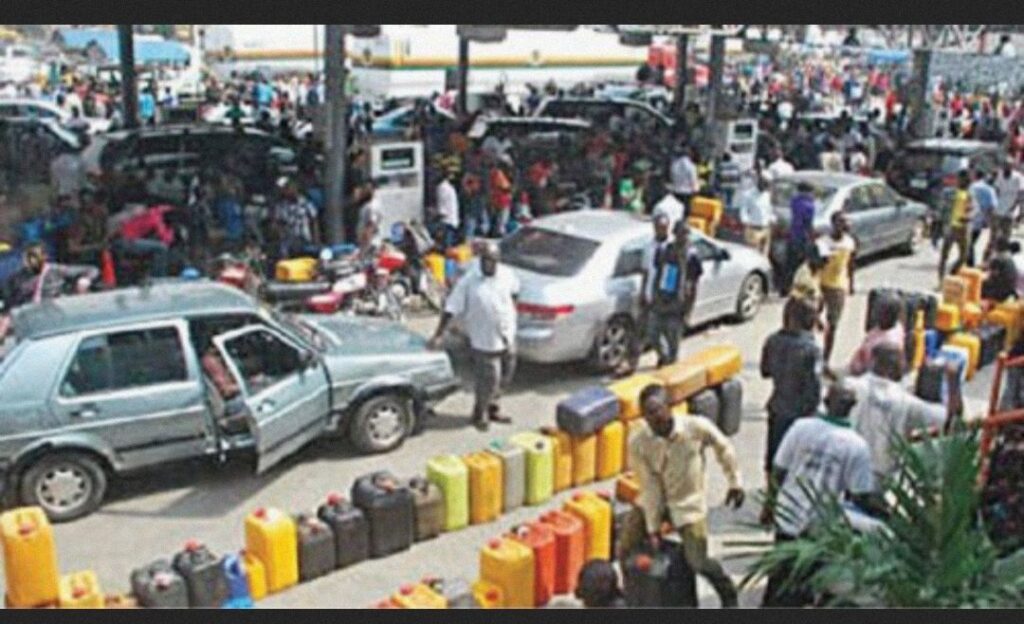

Currently, the NNPCL is facing inadequate supply to meet the nation’s demands, which has exacerbated product scarcity and inflicted severe hardships on the transportation sector and the entire citizenry in the past week. This shortage stems from suppliers’ reluctance to deliver the product on credit and an increase in smuggling activities.

According to recent transactional analysis obtained by Vanguard, the landing cost, including product cost, finance cost, freight, port charges, insurance, storage, and the Nigerian Midstream and Downstream Petroleum Regulatory Authority (NMDPRA), amounts to N1,205.52 per litre. However, when factoring in transportation costs, marketers’ margins, and dues, the estimated official pump cost of the product rises to N1,500 per litre.

These figures indicate that even at the proposed N1,000 per litre, the under-recovery (subsidy) would still be significantly high. This situation has presented the government with a dilemma, as they must choose between full cost recovery (total elimination of subsidy) or a compromise solution of splitting the cost between the government and final consumers if the pump price is set at N1,000 per litre.

The potential fuel price hike has ignited concerns among industry operators, consumers, and the general public. Many fear that an increase in pump prices will further strain the already burdened populace and exacerbate inflationary pressures. On the other hand, proponents argue that subsidy removal could lead to increased investment in the downstream petroleum sector, improved infrastructure, and a more efficient distribution system.

As Nigeria grapples with these critical decisions, stakeholders eagerly await official announcements and hope for a solution that strikes a balance between financial sustainability for the government and affordability for the citizens. The outcome will significantly impact the country’s economy, transportation sector, and the daily lives of its people.